One-on-one live online

Money Skills Training

Program for students

from class III to class X

Money Zinger is an innovative financial literacy training program designed to teach 7 to 15 years old students the role and importance of money management skills in today’s life

One-on-one live online

Money Skills Training

Program for students

from class III to class X

Money Zinger is an innovative financial literacy training programme designed to teach 7 to 15 years old students the role and importance of money management skills in today’s life

Money Zinger Primer Workshop For Schools

A two day (4-hour) Financial Literacy Primer Workshop for schools provides the students with a broad overview of the key concepts of financial literacy in an abridged form. The Primer workshop is available for students from Class 3rd to Class 10th. It is offered in both live online as well as offline format. A yellow belt certification is provided to each student after the successful completion of the workshop.

The Money Zinger Advantage

Financial Empowerment

Lays a strong financial knowledge foundation in the early years thus preparing students to confidently manage their personal finances as they grow

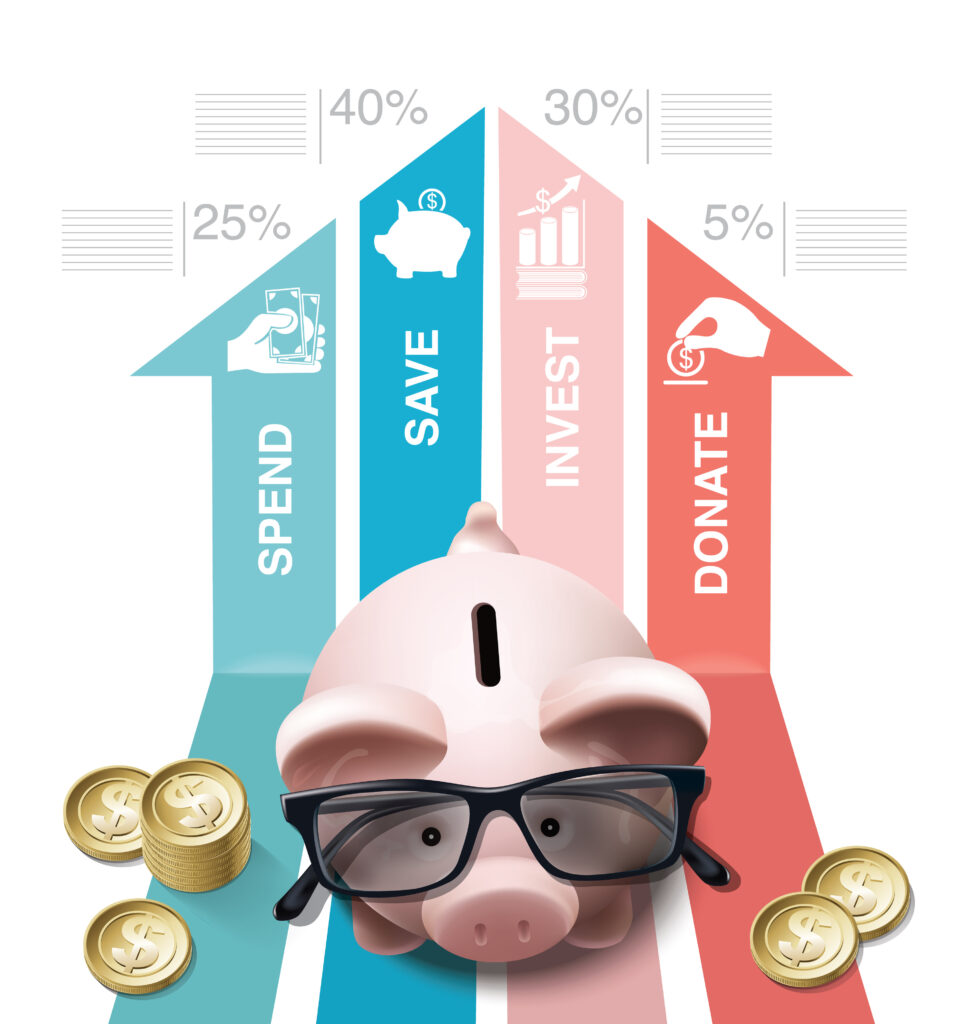

Money & Risk Management Skills

Inclucates the habit of saving and equips the students with the skills to pursue big financial goals with minimal risk.

Career Planning & Entrepreneurship

Emphasises the importance of career planning and helps explore popular career options in finance including entrepreneurship

Why Us?

Personalised

1-on-1 approach

Real life

examples

Easy to understand

curriculum

Quizzes & Capstone

Projects

Measurable

Results

Contact us

Why is financial literacy Important?

Whether parents realise it or not, children’s early experiences with money impact their financial decision making as adults. This is why it’s so important to help them acquire the knowledge and skills they need to build healthy financial habits at an early stage

According to an international research, if not introduced to key money concepts at an early age, it becomes challenging for people to handle finances efficiently later in their life. They have lower tendency to save and invest and are frequently caught in debt traps

Hence, parents must remember that to prepare their children for a better financial future, they must focus on imparting good money habits to their kids early in life

Benefits of financial literacy

Teaching students financial literacy from a young age comes with a variety of benefits, including:

- Children will understand the value of money and will begin to be more reasonable with their demands

- By being taught about financial risks, children will be better versed to avoid financial debt and bankruptcy in the future

- They will be more inclined to plan for future, such as saving for a holiday, investing in property, or even putting money aside for retirement

- They will lead happier and relatively stress-free lives – this benefit is one that is often forgotten about, but should be heavily emphasized when considering the long-term consequences of teaching financial literacy